EXTRANS GLOBAL - Air Freight News - Week 13 2024

Air Cargo General

1) The Ministry of Land, Infrastructure and Transport (MOLIT) is revising the allocation rules for transportation rights, and Korean Air is preparing for route transfers.

-

In the process of consulting with competition authorities in other countries for the merger between airlines, a clear legal basis has been established for the "transfer of transportation rights" to be implemented domestically.

-

Korean Air, which is merging with Asiana Airlines, has decided to transfer some of its European passenger route transportation rights to other airlines in order to alleviate concerns about competition restrictions.

-

According to the Ministry of Land, Infrastructure and Transport on the 24th, a legislative notice for the amendment of the "Rules on the Allocation of International Air Transportation Rights and the Use of Airspace and Air Traffic Rights" (Transportation Rights Allocation Rules) is being carried out until the 29th of next month. This amendment will allow airlines to transfer transportation rights to substitute airlines during the process of corporate mergers.The current rules do not provide a legal basis for domestic airlines to voluntarily return transportation rights, and only include a provision that authorities can reclaim transportation rights if airlines do not use them at a specific frequency.

-

The amendment introduces a provision that allows airlines to return transportation rights when "required or agreed upon by overseas competition authorities for corrective measures." The returned transportation rights will be redistributed according to the deliberation and decision of the Air Traffic and Transport Review Committee.

-

The amendment also includes a provision to return the returned transportation rights to the original airline in case the merger is ultimately unsuccessful.

-

The Ministry of Land, Infrastructure and Transport explained that they aim to establish a system that allows merged companies to implement corrective measures and promote a competitive environment in the air transport market after the merger, ensuring its maintenance and restoration.

2) TEMU and SHEIN are shaking up the global air cargo industry.

-

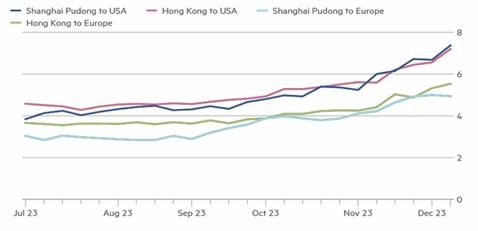

TEMU and SHEIN, fast fashion e-commerce retailers, are causing a stir in the global air cargo industry due to their rapid growth. This has led to competition for limited air freight capacity.

-

TEMU and SHEIN, shipping nearly 600,000 packages to the United States daily, have reported capacity shortages and increased air cargo costs at Asian hubs such as Guangzhou and Hong Kong, even during off-peak seasons.

-

The current trend impacting air cargo is not just limited to the Hong Kong region but also includes Chinese e-commerce companies like SHEIN and TEMU.

-

SHEIN currently holds approximately 2% of the global air cargo market share as of 2023, while TEMU holds around 1%.

-

These percentages are significant considering the dominance of individual e-commerce companies. SHEIN captures one-fifth of the global fast fashion market in terms of revenue and leads the growth of the Chinese e-commerce industry.

-

Fast fashion currently accounts for half of China's total cross-border e-commerce shipments and about one-third of long-haul cargo aircraft worldwide.

-

The sudden surge in demand for fast fashion since last year has led to increased air freight rates from China, raising concerns about long-term capacity shortages.

-

As of December 2023, TEMU handles approximately 4,000 tons of cargo daily, SHEIN handles 5,000 tons, and Alibaba handles 1,000 tons. This is equivalent to about 108 Boeing 777 freighters every day.

-

Even global companies like Apple transport a maximum of 1,000 tons per day. The increasing demand for fast fashion cargo has limited air capacity and is pushing traditional long-term customers aside.

-

With the rapid increase in demand for fast fashion since last year, concerns about long-term supply shortages have grown. It is projected that from 2022 to 2042, the number of cargo aircraft in China will increase by over three times, reaching an estimated 750 aircraft.

-

In response, SHEIN and TEMU are exploring ways to reduce air freight costs and utilize maritime freight and overseas warehouses. They aim to establish warehouses in key consumer regions overseas to store popular products in advance, enabling quick delivery after order placement. This strategy aims to enhance customer satisfaction, reduce logistics costs, and improve inventory management efficiency.

-

SHEIN has secured over 100 warehouses worldwide, expanding the areas where delivery can be made within 24 hours after ordering, including the United States, Europe, and Asia. TEMU also plans to establish its first overseas warehouse in the United States by 2023, with future expansion plans in Europe and Asia.

-

Operating overseas warehouses has significantly reduced delivery times and increased customer repurchase rates in the United States, Europe, Japan, and other regions.

-

This can have a substantial impact on the global air cargo industry and is expected to further expand as both companies continue their expansion in e-commerce.

3) The role of Vietnam's semiconductor supply chain as perceived by the United States is highly valued

-

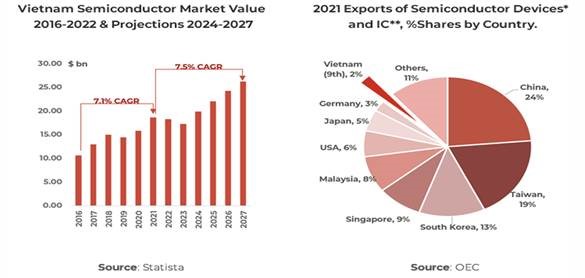

The United States is in need of a new partner in the semiconductor industry, based on low labor costs, to replace China. With geopolitical considerations in mind, Vietnam has emerged as a potential candidate for this role.

-

In terms of market size, Vietnam's share in the global semiconductor market is around 4%, surpassing countries like Thailand (2%) and Malaysia (3%). However, Vietnam still has a long way to go and is poised to seize new opportunities in line with the changing international landscape.

-

Vietnam has leveraged its low labor costs as a competitive advantage, focusing on low-entry-barrier back-end processes and aiming to expand its industry through attracting global semiconductor companies for the front-end processes. The role of Vietnam's semiconductor supply chain, as perceived by the United States, is believed to be in testing and packaging. Design is done in the United States, manufacturing in South Korea and Taiwan, and testing and packaging in Vietnam and other Southeast Asian countries.

-

While testing and packaging are considered as back-end processes in the semiconductor industry, their importance has been increasing in recent years.

-

Vietnam openly expresses its hope to serve as an alternative to China by diversifying the supply chain concentrated in China in the semiconductor and electronics industries.

-

The U.S. administration, under President Biden's intention, has announced its support for developing Vietnamese talent in the fields of science and technology, which are necessary for this purpose, including providing subsidies and other incentives.

-

Reports indicate that Vietnam is engaging in a competition to attract global semiconductor companies such as NVIDIA and Samsung Electronics, with promises of incentives, including subsidies, based on an interview with Huynh ThanhDat, Vietnam's Minister of Science and Technology.

4) Jeju Air conducts due diligence on the acquisition of Asiana Cargo by Bain & Company.

-

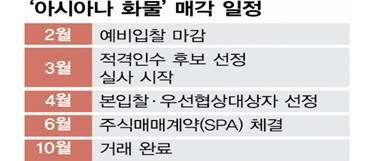

Jeju Air is conducting due diligence on Asiana Airlines' cargo business division in collaboration with Bain & Company. They are also actively considering a consortium proposal from multiple private equity (PE) funds.Previously perceived as somewhat indifferent towards the acquisition competition, Jeju Air has now emerged as the most promising candidate, showcasing a significant change in their approach.

-

Jeju Air has selected Bain & Company as the lead manager for the acquisition and is currently conducting due diligence on Asiana Airlines' cargo business division. Within Bain & Company, the industrial and service (AMS - Advanced Manufacturing Services) sector is highly regarded for its understanding of the aviation industry. In contrast to other potential acquirers such as low-cost carriers (LCCs) who engaged the top four domestic accounting firms as lead managers, Jeju Air opted for the global consulting firm, Bain & Company, despite the higher costs.

-

Jeju Air is actively considering a consortium proposal consisting of multiple PEs and financial investors (FIs). Until early last week, there were reports within the investment banking industry that Jeju Air was not even considering reviewing acquisition financing proposals. However, the situation quickly changed in the latter half of last week.

-

Competing LCCs are on high alert. Korean Air must obtain approval from the European Union (EU) and US competition authorities before completing the merger process with Asiana Airlines. The prerequisite condition set by these competition authorities is to bring in a viable acquisition candidate that can ensure effective competition. Industry insiders are voicing that, in reality, the only company that meets the conditions set by the competition authorities is Jeju Air, the top LCC in Korea.

-

The due diligence on Asiana Airlines' cargo business division is expected to continue until the 19th of next month. Once the due diligence is completed, Korean Air, Industrial Bank of Korea, and other selling parties will proceed with the final bidding and select a preferred negotiating partner. Potential acquirers are estimating the sale price for Asiana Airlines' cargo business division to be around 300 billion Korean Won.

5) 항공사/GSA Event update

(1) Agreement on Increased Air Traffic Rights at the Korea-Kazakhstan Aviation Dialogue

During the Korea-Kazakhstan aviation dialogue held from the 20th, both countries reached an agreement to increase air traffic rights. As a result of this aviation dialogue, the passenger traffic rights that were previously limited to 1,450 seats per week will be changed to a frequency-based system. The Incheon-Almaty route will be expanded to operate up to 7 flights per week, while all other routes except Incheon-Almaty will be expanded to operate up to 14 flights per week, allowing a total of 21 weekly flights. Additionally, the two countries have agreed to establish 20 weekly cargo traffic rights.

According to the Korea-Kazakhstan Air Transport Agreement, Korean designated airlines are Asiana Airlines and T'way Air, while Kazakhstan designated Air Astana as their airline.

(2) Eastar Jet (ZE) Regains Cargo Air Operator Certificate (AOC)

According to the Ministry of Land, Infrastructure and Transport and the aviation industry on March 25th, it has been confirmed that Eastar Jet has obtained a cargo AOC after approximately 4 years.

(3) Air Oké (RF) Expands Operations to Incheon Airport

After the mandatory use period at Cheongju International Airport hub ends in April, Air Oké plans to operate flights to Incheon-Tokyo/Taiwan and other destinations during the summer season. The planned period of operation is from late May to July.

(4) WestJet (WS) to Commence Direct Flights from Incheon to Calgary on May 18th

The ICN-YYC flight with the schedule 2245/1815 will operate three times a week. The sales will be conducted by GSA Good Man GSL. The aircraft model for this route will be the "B787 Dreamliner."

top