EXTRANS GLOBAL - Air Freight News - Week 09 2024

Air Cargo General

1)Will there be a consortium of logistics giants and LCC (Low-Cost Carrier) formed before the acquisition of Asiana Airlines Cargo?

The preliminary bidding for the sale of Asiana Airlines' cargo business, which is being pursued by Korean Air, will end on the 28th. Among the five domestic low-cost carriers (LCCs) considering acquisition, there is a growing interest in whether a logistics giant will join hands with an LCC and participate in the acquisition battle.

- UBS, the lead manager for the sale of Asiana Airlines' cargo business, has sent teaser letters (investment prospectus) to potential acquirers. The interested parties must submit a bid proposal, including funding plans and business plans, by 2 p.m. on the 28th.

- Asiana Airlines' cargo business owns a total of 11 cargo aircraft, including 8 owned cargo planes and 3 leased cargo planes. Its revenue last year was 1.6071 trillion won, and its domestic and international cargo volume is approximately 750,000 tons on average annually.

It is the second largest among domestic airlines, following Korean Air. The aviation industry expects the selling price of Asiana Airlines' cargo business to be around 500 billion to 700 billion won (excluding separate debt). - However, the aviation industry believes that the selling price could be lower during the negotiation process. The profits from Asiana Airlines' "belly cargo" operations, which involved transporting cargo on large passenger planes, have been reflected in the cargo business department so far. After the acquisition, these profits will be lost from actual revenue. Additionally, a significant number of aircraft are over 25 years old and in need of replacement. Furthermore, potential acquirers would have to take on the burden of the 1 trillion won debt of the cargo business department.

- The key factor in this acquisition battle is financial capability. It is a large-scale acquisition that requires an investment of at least 1 trillion won. This is why Eastar Jet and Air Premia, which have private equity funds as major shareholders, are considered favorable. VIG Partners is the major shareholder of Eastar Jet, while JC Partners is the major shareholder of Air Premia. These private equity funds manage more than 1 trillion won in funds. On the other hand, Jeju Air appears cautious. With only 300 billion won in cash reserves and its own cargo business already in operation, it plans to make a more careful decision as the participation of its parent company, Aekyung, is inevitable.

- Aero K is emerging as a dark horse in the acquisition battle for Asiana Airlines. It officially declared its participation in the acquisition of Asiana Airlines' cargo business on the 22nd. Daemyung Group is the major shareholder of Aero K. As it owns various fashion brands and Logen, a parcel delivery service, it expects logistics synergies and has decided to participate in the acquisition battle. It is also known to have strong financial backing. In addition, Air Incheon, the only domestic cargo airline, is planning to participate in this acquisition battle, but it is considered the weakest in terms of financial capability.

- LCCs are competing behind the scenes to attract logistics giants as strategic investors (SIs). If a logistics company participates as an SI, it can secure cargo volume stably even after the acquisition, and in the long run, the private equity funds that are the major shareholders of LCCs can transfer their shares to the SI and exit (recoup their investment). LX Group was mentioned first yesterday. It owns LX International and logistics company LX Pantos. It is evaluated that it can generate synergies in the logistics business based on the cargo volume of LG Group. Dongwon Group, which experienced a setback in the HMM acquisition battle, is also mentioned. Dongwon Group is in a position with a solid foundation in cargo transportation and international logistics after acquiring Dongbu Express in 2017. An investment industry official explained, "Not only large companies but also many mid-sized companies are showing interest and contacting the lead manager for the sale."

- However, some argue that there is insufficient information to evaluate the value of the asset. It is said that the investment memorandum (IM) distributed through UBS did not provide any information on the profitability, assets, or liabilities of the cargo business department. An aviation industry official said, "Korean Air needs to proactively disclose information about the sale business unit for the process to proceed normally." Korean Air plans to finalize the selection of the final bidders by October. Once the acquirer is selected, it will go through the approval process of the European Union (EU) competition authorities and conclude the divestment.

2) Increase in performance of Asia-Europe SEA & AIR hub airports.

- One of the many impacts of the Hong Kong crisis is the increase in ocean freight rates and the ripple effect of delays, leading to an increase in SEA & AIR services from Asia to Europe. This outlook has been highlighted in the recent weekly report from WordlACD, a global air cargo market analysis firm.

- Looking at the global air cargo market trends for week 7 as of January 18th, it can be observed that the demand for air cargo in SEA & AIR transshipment hub airports such as Dubai, Colombo, and Bangkok has been overflowing. According to WorldACD, "Looking at the performance of these airports in the first 7 weeks of this year, it shows a significant increase of over 50% compared to the first 7 weeks of last year. The volume of transportation between Dubai and Europe increased by 71%, Colombo-Europe by 61%, and Bangkok-Europe by 58%."

- This is clearly different from the performance increase of 3% to 10% for routes such as Singapore-Europe or Doha-Europe compared to the same period last year.

- Especially during the 7th week, which includes the Chinese New Year period (February 12th to 18th), the tonnage of Europe-bound flights from these three major airports significantly increased. Dubai-Europe increased by more than three times, reaching 161% (89% increase in the past three weeks), Bangkok-Europe increased by 112% in the 7th week (77% increase in the past three weeks), and Colombo-Europe increased by 112% (77% increase in the past three weeks).

- On the other hand, the global air cargo demand tonnage decreased by more than 10% compared to the previous week, reflecting the general decrease in demand and the downward trend of freight rates after the Chinese New Year.

3) Will the spring days of logistics continue to flourish due to the growth of e-commerce?

- The low-cost offensive of Chinese e-commerce platforms continues in Korea. Platforms such as AliExpress, Tmall, and others are quickly dominating the domestic e-commerce market by leveraging their logistics capabilities. The Korean landing of the wholesale site, 1688.com, is also imminent.

- CJ Logistics is currently the top logistics service company in the Korean e-commerce market. CJ Logistics reported sales of KRW 11.7679 trillion and operating profit of KRW 480.2 billion in 2023, marking a 16.6% increase in operating profit compared to the previous year.

- The key to CJ Logistics establishing itself as a logistics powerhouse in the e-commerce industry, regardless of borders, is its fulfillment service. By integrating the entire process under one roof, from a parcel delivery company to comprehensive logistics management, CJ Logistics has reduced the logistics management burden for sellers.

- In addition, CJ Logistics has announced a future vision of becoming an innovative technology company through the development of logistics technology in 2021. They are expanding investments in logistics automation, including doubling the size of the TES Logistics Technology Research Institute.

- While CJ Logistics has solidified its partnership with e-commerce platforms such as Naver and AliExpress, Coupang, on the other hand, has invested in its own logistics as an e-commerce company. Coupang has surpassed E-Mart, which had been the undisputed leader for decades, and has become the strongest player in the distribution industry. They have continuously invested in logistics despite the saying of "pouring water into a leaking bucket."

- Coupang's core competitiveness lies in "Rocket Delivery." They have invested approximately KRW 6.2 trillion in building a nationwide logistics network, focusing on expanding the "Cusekwon" (areas where Rocket Delivery is available). In 2022, they invested over KRW 320 billion to establish one of the largest fulfillment centers in Asia, the Daegu FC, incorporating advanced logistics technology and equipment such as AI and logistics robots.

- The efforts and investments have yielded visible results, with cumulative sales of KRW 23.1767 trillion and operating profit of KRW 444.8 billion in the first three quarters of the previous year. Especially in the third quarter, they surpassed KRW 8 trillion in sales, leading the industry to expect annual sales to exceed KRW 30 trillion.

- In the midst of this, will Qoo10, which has entered international logistics and sales platforms, become a strong competitor to Coupang and Ali?

- On the 13th, Qoo10 made a leap as the first global marketplace of Korean origin through its acquisition of WISH. WISH is a global e-commerce platform from the United States that provides services in over 200 countries and in 33 languages. Through this acquisition, Qoo10 has secured a broad global supply chain, including customers in previously relatively weak areas such as North America, Europe, Latin America, and Africa.

- What is particularly noteworthy is that WISH provides 4th Party Logistics (4PL) services in 44 countries and 3rd Party Logistics (3PL) services in 16 countries, based on its integrated logistics solutions in those regions.

- Qoo10 has already been providing overseas sales bases to domestic sellers through its logistics subsidiary, Qxpress. Sellers who have partnered with Qoo10's affiliates such as TMON, WeMakePrice, and Interpark Commerce can utilize Qxpress' fulfillment service, "Qx Prime," for integrated domestic and international shipping and global logistics infrastructure. They expanded their services by opening the QDPC Icheon (Qxpress Digital Partner Center), a logistics center with a floor area of 33,000 square meters, in Icheon, Gyeonggi Province, last year.

- The industry is paying attention to whether Qoo10, with its acquisition of WISH and the establishment of a global supply chain, will grow to the extent of challenging world-renowned cross-border companies such as Amazon and Ali.

4) Airfares from China have slumped after the Lunar New Year holiday

- Airfreight rates in Asia have shown a downward trend after the holiday season.

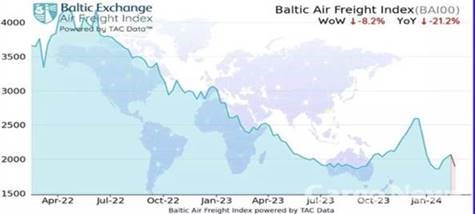

- As of February 19th, the global average airfreight rates decreased by 8.2% compared to the previous week. They also dropped by 21.2% compared to the same period last year. Specifically, airfreight rates from Hong Kong (HKG) recorded a decrease of -13% compared to the previous week.

- According to the Baltic Airfreight Index (BA) compiled and released by TAC, airfreight rates from Shanghai (PVG) also decreased by 11.5% compared to the previous week. They were down by 5.4% compared to the same period last year.

The decline in airfreight rates is analyzed to be due to Chinese manufacturing companies not yet engaging in full-scale production after the holiday season. - The demand for airfreight to Dubai (DXB) and Bangkok (BKK) is increasing due to the Hong Kong sea dispute. It is also analyzed that there is an increasing demand for airfreight to India, Europe, and the United States, as the maritime supply chain disruptions are redirecting demand towards the air cargo market.

- On the other hand, airfreight rates from Frankfurt (FRA) increased by 6.7% compared to the previous week. This is attributed to the increased demand for shipments from Frankfurt to China and Southeast Asia. However, they are still 39.7% lower compared to the same period last year. Airfreight rates from London (LHR) decreased by 6.9% compared to the previous week and remain 51.3% lower compared to the same period last year.

- However, airfreight rates from Chicago (ORD) increased by 2.4%. This is due to the increasing demand for airfreight to Asia. However, airfreight rates from Chicago still remain 31.3% lower compared to the same period last year.

5) Airline/GSA Event Update

(1) Korean Air and T'way Air considering leasing the latest A350 aircraft

Korean Air has recently expressed its intention to lease the Asiana A350-900 aircraft to T'way Air. Asiana currently operates 15 A350-900 aircraft under long-term leases, and Korean Air plans to lease 3 of them to T'way Air after the merger. Previously, Korean Air supported T'way Air with 5 A330-200 aircraft, and T'way Air currently operates 3 wide-body aircraft with plans to acquire 2 more this year. T'way Air plans to launch flights to Zagreb in April, Paris in June, Rome in August, Barcelona and Vancouver in September, and Frankfurt in October. With the addition of 3 more A350-900 aircraft from Asiana, T'way Air is expected to enhance its competitiveness.

(2) American Airlines (AA) to operate daily non-stop flights on the JFK-HND route

Starting from June 28th, American Airlines will operate daily flights on this route.

JFK-HND: 1125/1430+1, HND-JFK: 1630/1635, B772, except on June 8th.

(3) Malaysia Airlines (MH) increases frequency on Kuala Lumpur-Incheon route to 12 flights per week

An additional 5 flights (D14567) will be added. ICN-KUL: MH039 0010/0545, KUL-ICN: D34567 1450/2230, starting from April 25th, A333 aircraft.

(4) Garuda Indonesia (GA) increases frequency on Incheon-Jakarta/Bali route to a total of 12 flights per week

ICN-CGK: 4W to 5W (D23567) GA879 1035/1540, CGK-ICN: D (12467) 2315/0830+1, A333 aircraft.

ICN-DPS: 4W to 7W GA871 1125/1720, DPS-ICN: GA870 0115/0915, A333 aircraft.

(5) Indian government announces liberalization of cargo aircraft operations by foreign carriers for a period of 3 years

Recently, the Indian government declared a liberalization of aviation policies, allowing foreign cargo airlines to operate at all international airports in India for a period of 3 years.

top